Pell Grant

We love the Pell grant!** The Pell grant is the US financial aid system's flagship award — every year, Solano awards its students **millions** of dollars through the program. Since the passage of the *Higher Education Act of 1965,* the landmark legislation authorizing national need-based financial aid, the Pell has been the foundational grant around which all other awards build upon. In short, when you think of "financial aid," you're probably thinking of Pell!

**How does it work?**

The only way to apply for the Pell is to submit a FAFSA. The Pell is awarded based on a student's financial need, which is calculated using a [[#What is the Student Aid Index (SAI)?|government formula]] using the tax information you and/or your contributors provide on your FAFSA as well as other information. Students with more need are awarded more Pell, while students with less need are awarded less Pell or are ineligible. Additionally, Pell is based off your [[#^65e680|enrollment intensity]], which means you won't actually receive all the Pell you were awarded unless you are a [[#^full-time|full-time]] student.

While you are shown an estimate of your Pell award when you complete your FAFSA, it's important to remember that you won't know your actual Pell award that Solano is offering you until you see it on MySolano → Financial Aid Tab → [[#How do I see my award summary? ==(WIP Pics)==|Award Summary]]. This may take up to 2 weeks to appear after submitting your FAFSA.

Once you are awarded the Pell, you must [[#What is BankMobile and how do I activate my account?|activate your BankMobile account]] in order to be able to receive your Pell [[#^69f27e|disbursement]].

Solano disburses Pell funds twice per semester, once at the beginning and once at the midpoint. If you are awarded your Pell late, you'll receive all owed disbursements at the first disbursement date you are eligible.

**How do I know if I'm eligible for the Pell Grant?**

To be eligible for Pell, you must

- Be a US citizen or [[#^eligible non|eligible noncitizen]]

- Not have earned your bachelor's degree or any kind of advanced degree

- Have [[#^cc4ef7|financial need]]

- Not be in [[#^9fc3c7|overpayment]] or default on a previous federal financial aid program ^526720

- Maintain [[#What does Satisfactory Academic Progress (SAP) mean?|Satisfactory Academic Progress]]

- Have a [[#I didn't graduate high school or obtain a GED or equivalent. What are my options for financial aid?|high school diploma, GED, or state-issued equivalent]]

- Have not exceeded your [[#^f6e5b9|Lifetime Eligibility Usage]]

##### How do I know how much money will I receive?

The amount that you are awarded can change based on your **enrollment intensity** (*i.e.,* the number of units you're taking, maxing out at 12) and your unmet need.

###### What is Enrollment Intensity for Pell Grant?

Enrollment intensity refers to how many units you're taking in a given term. It is used in the context of financial aid awards in which eligibility varies in proportion to the number of units you're enrolled in—your enrollment intensity. For the fall and spring semesters, financial aid eligibility increases with each additional unit you take, capping out at 12 units (full-time).

Enrollment intensity does NOT work the same for Pell and Cal Grants. Pell is exactly proportional, meaning every additional 0.5 units will increase your Pell award. Conversely, Cal Grant uses 3 levels of enrollment intensity: half-time, three-quarters-time, and full-time, which correspond to 50%, 75%, and 100% of your semester award, respectively. Cal Grant is not awarded to less-than-half time students (students with 0.5–5.5 units), while Pell is.

Each additional unit you take up from 6 up to a maximum of 12 (full-time) gets you more Pell. Your semester award (maximum possible Pell you can receive in a semester, *i.e.,* your annual award divided by 2) is multiplied the proportion of units you're taking over 12. For example, if you're taking 6 units, you would multiply your semester award by 1/2 or half (50%) of the total. If you're taking 9 units, you would multiply your semester award by 3/4, or 75% of the total. If you're taking 10 units, you would multiply your semester award by 10/12, or 83.3% of the total.

###### Pell Grant Enrollment Intensity Chart

| Units | Enrollment Intensity | Pell Annual† Award | Pell Semester Award†† | Actual Annual† Award | Actual Semester Award†† | Disbursement Amounts (Fall/Spring) |

| -------- | -------------------------------- | ------------------ | --------------------- | ----------------------------------------- | ---------------------------------------- | ---------------------------------- |

| 1 unit | (1/12) = 8.33% = 0.0833 | $7395 | $3697.5 | $7395 × 0.0833 = $616 | $3697.5 × 0.0833 = $308 | ($308/2) = $154 |

| 2 units | (2/12) = (1/8) = 16.66% = 0.1666 | $7395 | $3697.5 | $7395 × 0.1666 = $1232 | $3697.5 × 0.1666 = $616 | ($616/2) = $308 |

| 3 units | (3/12) = (1/4) = 25% = 0.25 | $7395 | $3697.5 | $7395 ÷ 4 = $1848 | $3697.5 ÷ 4 = $924 | ($924/2) = $462 |

| 4 units | (4/12) = (1/3) = 33.33% = 0.333 | $7395 | $3697.5 | $7395 × 0.333 = $2464 | $3697.5 × 0.333 = $1232 | ($1232/2) = $616 |

| 6 units | (6/12) = (1/2) = 50% = 0.5 | $7395 | $3697.5 | $7395 ÷ 2 = $3698 | $3698 ÷ 2 = $1848 | $1848 ÷ 2 = $924 |

| 9 units | (9/12) = (3/4) = 75% = 0.75 | $7395 | $3697.5 | 3 units ($1848) + 6 units ($3698) = $5546 | 3 units ($924) + 6 units ($1848) = $2772 | $2772 ÷ 2 = $1386 |

| 12 units | 1 = 100% | $7395 | $3697.5 | $7395 × 1 = $7395 | $3698 × 1 = $3698 | $3698 ÷ 2 = $1848 |

† = These awards assume the student is not enrolled for summer. A student's Pell will increase if they enroll in summer. This is called [[#^fc38d3|year-round Pell]]. Summer is treated the same as fall or spring, except that summer payments are disbursed in 1 single disbursement at the beginning of the term as opposed to 2 disbursements (1 at the beginning and 1 at the midpoint) for fall and spring. The annual award for year-round Pell would be $7395 + $3697.5 = $11092.5 in this example. The summer disbursement would be equivalent to the actual semester award.

†† = Most disbursements round down to the nearest dollar, so I've done that in this example. When an annual award is odd, as in this example, the end result would be that one semester award is $1 greater than the other. This applies to all types of cash aid which with an annual award of an odd number.

If the amount of units you're taking is not on the chart, you can add up the numbers to make the math easier. For example, if you're taking 8 units and you want to know how much you'll receive for your first fall disbursement, you could add the disbursement amount for 6 units ($924) and for 2 units ($308) to get $924 + $308 = $1232.

For comparison, here is the Cal Grant Enrollment Intensity Chart

>[!Tip]- Cal Grant Enrollment Intensity Chart

> Cal Grant Enrollment Intensity Chart

>

> | Units | Enrollment Intensity | Cal Grant Annual Award | Cal Grant Semester Award | Actual Annual Award | Actual Semester Award | Disbursement Amount |

> | ---------------- | -------------------------------------- | ---------------------- | ------------------------ | -------------------- | --------------------- | ------------------------------ |

> | 0.5–5.5 units | ineligible | ineligible | ineligible | ineligible | ineligible | ineligible |

> | 6–8.5 units | half-time = 1/2 = 50% = 0.5 | $3000 | $1500 | $3000 × 0.5 = $1500 | $1500 ÷ 2 = $750 | $750 (paid once per semester) |

> | 9–11.5 units | three-quarters time = 3/4 = 75% = 0.75 | $3000 | $1500 | $3000 × 0.75 = $2250 | $2250 ÷ 2 = $1125 | $1125 (paid once per semester) |

> | 12 or more units | full-time = 1 = 100% | $3000 | $1500 | $3000 × 1 = $3000 | $3000 ÷ 2 = $1500 | $1500 (paid once per semester) |

>

>[!tip]- "Part" of my Pell? How do I know how much each part will be?

>Let's work through an example to understand the process of partial disbursements due to late start units. While this process is actually quite simple, it's not necessarily intuitive.

>

>In this example, we will need to first find the amount of the first Pell disbursement. Then we will do a bit more math to determine the second and third Pell disbursements.

>

>This formula, enrollment intensity x disbursement award, can also be used to calculate partial Pell awards if your total units are between 6 and 12. It's a simple process, but not an intuitive one.

>

>1. First, determine how many units are regular start and how many units are late start. You can see how many units you're taking on the Student tab of your MySolano. Let's say you have 10 units, of which 7 are regular start and 3 are late start.

>2. Next, we need to know the amount you have been awarded. To do this, go to MySolano → Financial Aid Tab → Financial Aid Award. The number shown next to your Pell grant is called the [[#^69ebbd|annual award]]. For this example, let's assume your annual award is $7395. Remember that this number is the ==maximum== you can receive in a year—it is NOT what you *will* receive in a year. We will figure out how much you *will* receive in the next step.

>3. Note: the annual award includes fall and spring combined. Summer is not included. If you enroll in summer term, your annual award will increase to accommodate this.

>4. The expected amount you will receive for the year is called the [[#^960274|scheduled award]]. It is not shown on your MySolano. You will need to do a small math problem to determine the scheduled award. Multiply the annual award by fraction of units you are taking ==which are financial aid eligible== over 12. In this example, you are only taking 7 regular start units, so your scheduled award is `(7/12) x ($7395) = $4314.`

>5. There is still one more step before we know how much we will receive in the first Pell disbursement, which is to divide by 4. We do this because there are 4 regular Pell disbursements per year (2 in spring and 2 in fall). Both semesters have Pell disbursements at the beginning of the term and about 1 month in. `$4314/4 = $1079.` This is the amount of money you will receive for the **first** Pell disbursement and will occur in either mid-August or mid-January.

>6. Assuming your late start classes begin after the **second** Pell disbursement (*e.g.,* the class begins in October and the second Pell disbursement is in September) this disbursement will be the same as the first. So you can expect to receive another $1079 in September.

>7. Now, in October, your 3 unit late start class begins and your financial aid eligible units increases from 7 to 10. To know how much you can expect to receive in your **third** disbursement, you will need to know how much you should expect for the entire semester ==including the late start units.== We need to do Steps 3 and 4 again, except with different numbers. In Step 3, we will use 10 units instead of 7 to account for the additional late start units. `(10/12) x ($7395) = $6163.` In Step 4, we will now use $6163 instead of $4314. `$6163/4 = $1541.`

>8. Your third disbursement will make up the difference between your previous 2 $1079 disbursements and your new eligibility, which is for 2 disbursements of $1541. `(2 x $1541) - (2 x $1079) = $924.` Your third disbursement will be $924. It will be disbursed to you on the first Monday after your late start class begins (excluding holidays) and arrive about 1 week later.

>

> To understand how Cal Grant will be affected by partial disbursements due to late start units, repeat the above process using the "3 bucket" (half-time, three-quarters time, and full-time) enrollment intensity formula for Cal Grant instead of the direct proportion enrollment intensity formula.

^799cfb

^73d270

##### Step-by-Step Example

1. Find your **annual award**.

1. Log into MySolano.

2. Go to the Financial Aid Tab.

3. Click on "Award Summary."

4. The number next to Pell grant is your annual award. (Remember that your annual award is divided by 2 to find your semester award.)

2. Write down your annual award. Most annual awards are a few thousands dollars, up to a maximum of $7395 (as of the 24–25 aid year). For this example, let's say your annual award is $5500.

3. Count your units.

1. Log into MySolano.

2. Go to the Student tab.

3. Click on Add or Drop classes

4. Under Drop classes, add up the amount of units. For this example, let's say you are taking 10 units.

4. Divide your units by 12.

1. 10/12 = 5/6 = 0.8333 or 83.3%.

5. Divide your annual award by to 2 get your semester award.

1. $5500/2 = $2750.

6. Multiply the number you got in Step 4 by the number you got in Step 5

1. 0.8333 x $2750 = $2291.61. Rounded down, that's $2291.

7. $2291 is your semester award. This is the total amount of money you should anticipate being deposited into your bank account over the course of the semester.

1. Please remember that, due to how awards handle dividing odd values for annual awards over 2 semesters (or an odd semester award value over 2 payments), it may differ by $1

##### What about summer Pell, also known as [[#^fc38d3|year-round Pell]]?

If a student receives Pell in summer, it does **not** subtract from their annual award. It adds onto it. Let's say your annual award is $5500, as in the example above. Let's say you take 10 units in fall, 6 units in spring, and 7 units in summer. Your semester award is $2750. This now applies to summer as well (even though summer is [[#What's the difference between a "semester" and a "term"?|technically a "term" and not a "semester")]]. So your Pell in fall is (10/12) x 2750 = $2292. Your Pell in spring is (6/12) x 2750 = $1375. Your Pell in summer is (7/12) x 2750 = $1604. The main difference is that you'll receive all your summer Pell in 1 disbursement at the beginning of the term, while in fall and spring you will receive it in 2 equal disbursements.

##### How to Avoid Overpayments

In certain circumstances, federal regulations may require a student to pay back financial assistance. This is known as an [[#^9fc3c7|overpayment]]. It's important that students know exactly what will trigger an overpayment so they aren't met with any unpleasant charges partway through the term.

If you are paid Pell and subsequently drop some—but not all—of your classes, you may trigger an overpayment. If you drop your classes before the freeze date (typically about 1 month into the semester), you will have to pay the entirety of the Pell for the dropped units. If you drop after the freeze date, you will not have to pay back Pell. You can use the step-by-step example above to calculate how much Pell would be for any amount of units.

> [!note]- What if I was dropped by an instructor?

> If you were dropped from a class by an instructor, it may not be immediately clear what the exact date that you were dropped was. You can always call us or come to the financial aid window and we'd be happy to assist.

If you withdraw from or receive all Fs/Ds in **all** of your classes, you will trigger a "Return 2 Title IV" (R2T4). This is a special type of overpayment where you may or may not be required to pay back a **significant amount of money**. Like with regular overpayments, the difference is in the exact timing of when you drop the classes. However, unlike regular overpayments, it is not solely determined by dropping before or after the freeze date. If you are concerned you may trigger a R2T4 overpayment, we recommend you contact the Financial Aid Office for accurate information. For more information, go to the R2T4 webpage.

For more details about the Federal Pell Grant program (including eligibility, maximum award amounts, and lifetime eligibility usage limits), visit [https://studentaid.gov/understand-aid/types/grants/pell](https://studentaid.gov/understand-aid/types/grants/pell)

#### **Federal Supplemental Educational Opportunity Grants (FSEOG)** √

The FSEOG is a relatively small program targeted towards students with the highest need.

##### How does the FSEOG work?

At Solano, we usually have more eligible students than funds for the program. As such, we distribute FSEOG funds to eligible students on a lottery system. That is, who actually awarded the FSEOG is chosen randomly from the set of students who are eligible. Each student receives the same total amount of FSEOG funds per term.

> [!warning]

> There is no guarantee you will receive the FSEOG in the future if you have previously received the FSEOG.

>

##### How do I know if I'm eligible for the FSEOG?

Eligibility is based on a few factors. You

- Must have the minimum [[#What is the Student Aid Index (SAI)?✓|SAI]] (between 0 and -1500)

- Not have earned your bachelor's degree or any kind of advanced degree

- We must receive your FAFSA before the first day of classes

- Maintain [[#What does Satisfactory Academic Progress (SAP) mean?|Satisfactory Academic Progress]]

##### How much will I receive from the FSEOG?

The minimum allowed by regulations is $100 and the maximum is $4,000. At Solano, the exact amount of the award changes from year to year. Each student at Solano receives the same award amount for a given semester.

#### **Federal Work-Study (FWS)**

The Federal Work-Study (FWS) program is a federal campus-based program that provides jobs for eligible undergraduate students whose unmet need exceeds $1000. FWS allows students to earn money to help pay educational expenses.

##### How does FWS work?

To receive FWS, a student must be eligible for the program and have a job lined up on-campus or with an approved off-campus community service position. At that point, contact the Financial Aid Office to activate your FWS for that job.

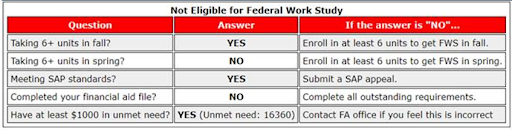

##### How do I know if I'm eligible for FWS?

To receive FWS, you must

- Have $1000 or more in [[#^cc4ef7|unmet need]]

- Be taking 6 or more units

- Have filled out the FAFSA

- Maintain [[#What does Satisfactory Academic Progress (SAP) mean?|Satisfactory Academic Progress]]

You can check your eligibility in MySolano: ^889c68

1. Login Into MySolano

2. Click on Financial Aid Tab

1. On mobile, it will be an icon of a credit card

3. Under the FA Requirements section, click on the Financial Aid Status link

4. Click on Financial Aid Tab at the top of this new screen

5. Click on Eligibility

6. Click on Student Requirements

1. This will show if you are eligible for Federal Work Study. If you are eligible, the box at the top will be green. If you are not eligible, it will be red.

##### What else do I need to know?

Unlike most financial aid, FWS is **NOT applied automatically**. You must first apply for and receive a FWS-eligible job before you can activate FWS by contacting the Financial Aid Office.

It's also important to note that FWS funds can run out for a given semester, so you should ask the Financial Aid Office if they anticipate this impacting your financial aid. However, at Solano, it is not common for FWS funds to run out for a given semester.

##### How to Get FWS Step-By-Step

1. Verify you are eligible for FWS by following the steps above

2. Contact the Financial Aid Office to verify that there is still FWS money available to award

3. Find a campus department willing to hire you for a work-study position on campus

1. The best way to find a work-study position is to search the [Career Center jobs database](https://www.collegecentral.com/solano/) to find a work-study position offered on campus

2. Though rare, some off-campus jobs are also work-study approved

4. Complete the hiring process with your new job

5. Contact the Financial Aid Office or, alternatively, tell your new supervisor to contact us so we can activate your FWS award for that job

[Looking for a FWS Job? Click here!](https://www.collegecentral.com/solano/)

[SCC Student Worker Hiring Information Here](https://welcome.solano.edu/hr-student-worker-hiring/%20)

#### **Federal Direct Loan Program**

Solano Community College participates in the William D. Ford Federal Direct Loan Program and offers Direct Subsidized and Direct Unsubsidized Loans. (We do not offer Direct PLUS Loans.)

##### How does the direct loan program work?

Unlike most forms of financial aid, loans must be **requested.** There are several steps a student must complete to request a loan; for more information, visit the [4 Steps to Request a Loan](https://welcome.solano.edu/fa-direct-loans-request-process/) page.

The primary difference between subsidized and unsubsidized loans involves the treatment of interest while the student is still in school. Direct Subsidized Loans do not accrue interest until the student has graduated, dropped below half-time status (below 6 units), or withdrawn from school entirely. Conversely, Direct Unsubsidized Loans will begin to accrue interest immediately. As interest accrues, the amount that a student will owe back to the government will increase.

> [!tip]

> Because subsidized loans are a much better financial deal than unsubsidized loans, they are only available to students with financial need (unmet need >$0).

##### How do I know if I'm eligible for loans?

To be eligible for either kind of loan, these shared eligibility criteria apply:

- Enrolled in 6 or more units

- Be in an FA-eligible major program

- Submit a FAFSA

- Be a US citizen or eligible noncitizen

- Not be in default or overpayment status

For unsubsidized loans, the following eligibility criteria also apply:

- May be an undergraduate or graduate student (the latter does not apply to Solano)

For subsidized loans, the following eligibility criteria also apply:

- Must have financial need (unmet need >$0)

- Must be an undergraduate student

For more information on the Federal Direct Loan program, including annual and lifetime maximum amounts, repayment plans, and alternatives to lending, visit: [https://studentaid.gov/understand-aid/types/loans](https://studentaid.gov/understand-aid/types/loans)

For information on how to apply for Direct Loans at Solano, check out our Direct Loans page featuring our FAQ **[here.](https://welcome.solano.edu/fa-direct-loans/)**

[Request a Loan in 4 Steps](https://welcome.solano.edu/fa-direct-loans-request-process/)